Mileage Receipt

With this improved feature in Expense Management companies can extract information about claimable VAT from mileage fuel receipts. In order to claim the VAT on mileage claims a fuel receipt s covering the claim must be kept.

How To Record Mileage Help Center

As self-employed you can claim mileage with one of two different methods simplified vehicle expenses or actual vehicle costs.

. The templates help you track the number of miles your vehicle has traveled in a specific time period. The amount of money you can claim is set down in HMRCs Approved Mileage Allowance Payments AMAPs and under legislation enacted in 2011 is 45p per mile for cars and vans for the first 10000 miles. Petrol receipts with mileage claims A new rule has recently required that all employees who receive a payment based on business miles submit some receipts for fuel along with each mileage claim these receipts are not expected to tally with the re-imbursement you receive but serve to prove that fuel is in fact being put into your vehicle.

Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p. You just need a VAT receipt which shows the amount of total VAT you have paid on fuel for the period of the mileage claim is more than the VAT being claimed by the company for the mileage paid. Only payments specifically for.

Fill with 50 litres VAT will be 7-8. CarVan 45p per mile for the first 10000 business miles 25p per mile from 10000 miles Carrying a passenger Additional 5p per mile Motorcycle 24p per mile Bicycle 20p per mile. - Mileage reimbursement is employer-set compensation for work-related use of your personal vehicle.

Enter your route details and price per mile and total up your distance and expenses. Download Mileage Receipt Mileage-Receiptpdf Downloaded 4 times 46 KB. Jan 11 2019 1 Question for the tax expertsavoiders on here.

You can improve your MPG with our eco-driving advice. In order to reclaim these expenses detailed records must be kept. The answer is yes you must keep the fuel receipts if you want to claim the VAT on the mileage expenses.

They will use things like the MOT etc for proof of mileage if you were ever to be investigated so just make sure you not claiming 10k every year and the car is only doing 5k lol. Download Mileage Receipt ExampleTemplate FREE Printable Format. Start date Jan 11 2019.

However if an employer reimburses in excess of this then they need to report this on a P11D so that the taxable reimbursement. As already stated the receipts mean nothing if you are claiming mileage and they wont prove anything should you be investigated. These logs should include the following information.

Date of journey Start and end address including postcode Purpose of journey Any amounts reimbursed by your employer. Fuel and wear and tear. As an employer you may want to think about passenger rates.

They give a value to your business journey in pence per mile. The employer reimburses at 15p per mile for a total of 1725 11500 at 15p. 1 of 2 Go to page.

You should keep all receipts of your business travel spending. Download Mileage Receipt Mileage-Receiptpdf Downloaded 4 times 46 KB. For vans and cars during the first 10000 miles youll be able to claim up to 45p per mile and then 25 ppm after that.

When using a vehicle for your business its important to keep accurate records of every work journey including the dates and mileage. Claiming mileage with the actual vehicle costs method means youll have deductions for every penny youve spent on business mileage for the year. Fuel receipts to support claiming VAT on mileage The question often arises Do I need to keep fuel receipts as Im not claiming for the fuel I purchased.

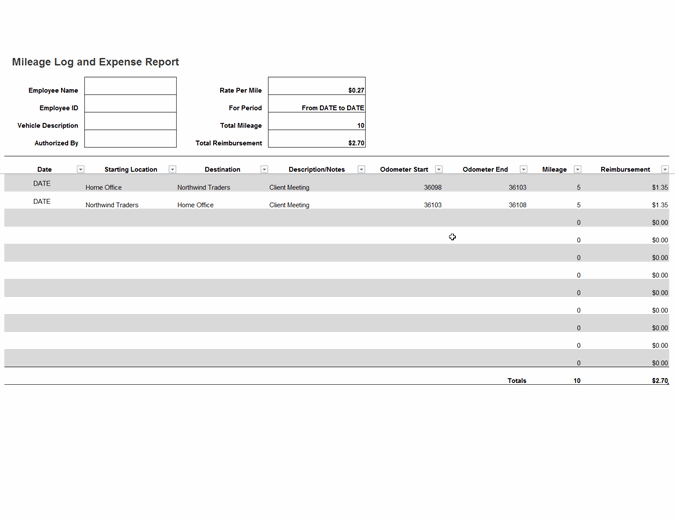

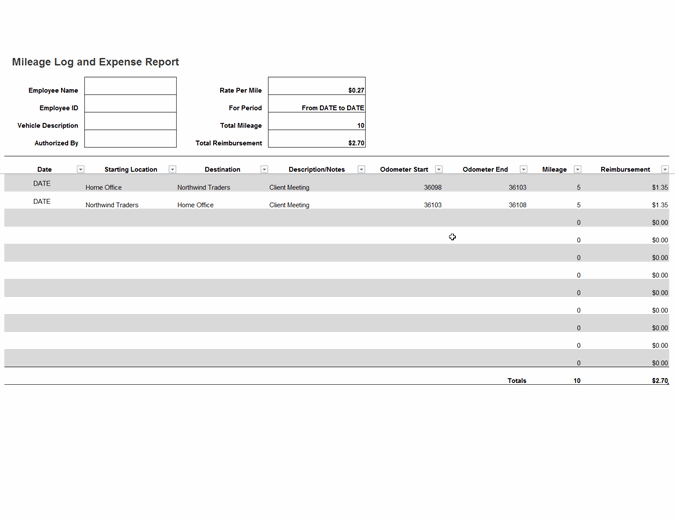

Report your mileage used for business with this accessible mileage log and reimbursement form template. The 45ppm is split into two consecutive parts. As fuel VAT is only about 25p per mile for 45p a mile mileage claim its not too onerous.

Some of the costs that you may include are Depreciation Lease payments Fuel Maintenance expenses. The current starting in 2018 IRS standard mileage rate is 545 cents per business mile. Read more information about car running costs in our driving advice section.

The second method involves determining the percentage use of the vehicle for business purposes and multiplying by the total expenses from the use of the vehicle. The employee can therefore claim tax relief on 4875 the maximum tax-free payment available less 1725 amount employer pays 3150. The maximum claim is 10000 miles at 45p and 1500 at 25p for a total of 4875.

This can be confusing as you dont claim the VAT back on the fuel purchased so the receipt seems pointless. Thread starter Bob Fleming. This mileage reimbursement form template calculates amounts for you to submit as an expense report.

Mileage receipts - HMRC - contracting. Authorised rates for business mileage reimbursement AMAP for private cars and vans utilised for business use are set by HMRC at 45p per mile for the first 10000 business miles and then 25p per mile thereafter. Expense report with mileage.

This information can be used for tax deduction purposes. In this instance a log would be kept of the mileage used for business and multiplied by the deduction rate published by the IRS. Feature details Expense Management will help calculate VAT refunds on mileages when receipts for fuel are provided.

The mileage allowance must cover the fuel portion of the mileage claim. Claiming your business miles is a form of tax relief meaning the cost of your mileage will reduce your tax bill at the end of the year. This app provides accurate automatic mileage.

HMRC sets Approved Mileage Allowance Payments AMAPs. As an employee if I use my own car for work and make a mileage claim is there any obligation from HMRC that receipts must be kept. Currently they are set at.

Routes are automatically saved. Anything over 10000 miles is paid back at 25p per mile. Passenger payments cars and vans 5p per passenger per business mile for carrying fellow employees in a car or van on journeys which are also work journeys for them.

Download our free mileage claim template form as an Excel spreadsheet. The amount youll get back will factor in the number of miles you do. Use this mileage reporting form to keep track of your destinations traveled miles driven and total amount reimbursable.

In order to make a claim for mileage allowance relief you need to maintain details of the journeys you have undertaken for work. However those are the HMRC rules so yes you and your employees must provide fuel receipts if you wish to include VAT on mileage claims.

![]()

Free Mileage Tracking Log And Mileage Reimbursement Form

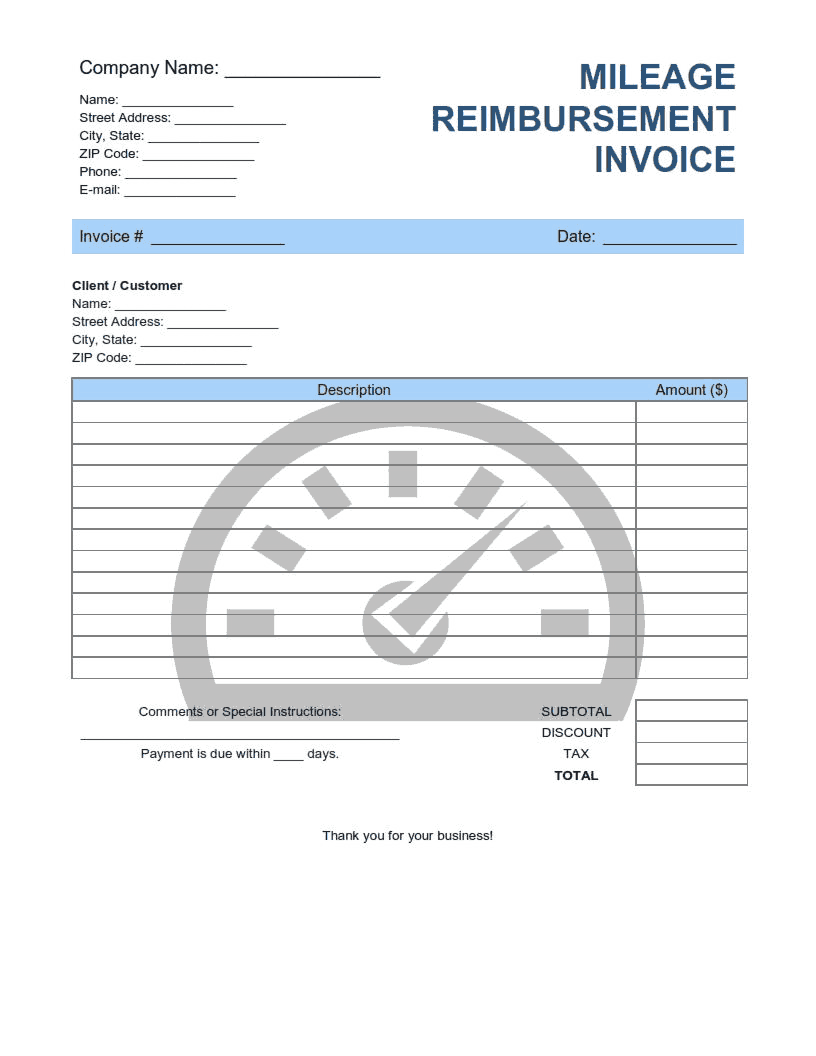

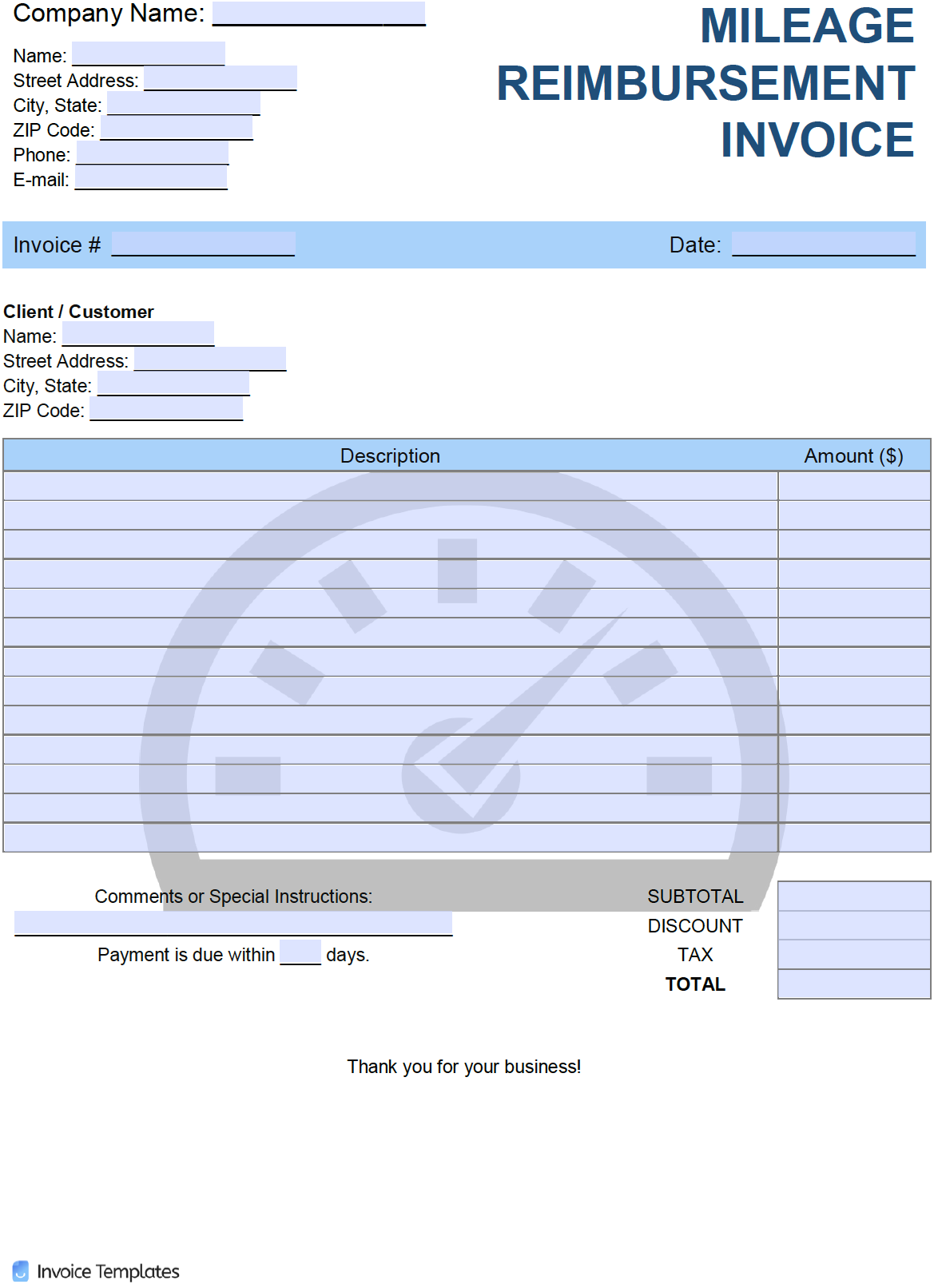

Mileage Reimbursement Invoice Template

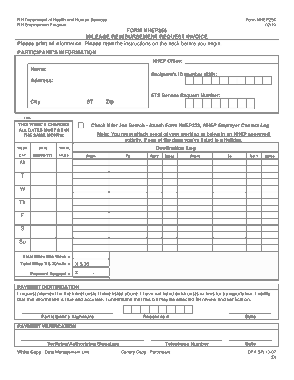

Mileage Reimbursement Request Invoice Form Template Free Download Free Pdf Books

Mileage Log And Expense Report

Mileage Reimbursement Invoice Template Word Excel Pdf Free Download Free Pdf Books

Free Mileage Reimbursement Invoice Template Pdf Word Excel

Entering And Repaying Mileage Inniaccounts

Mileage Reimbursement Form Template Mileage Reimbursement Mileage Log Printable Mileage Printable

Comments

Post a Comment